Tax compliance is a vital aspect of financial responsibility for individuals and businesses alike. Missing tax deadlines can lead to penalties and unnecessary stress. To ensure smooth tax management, it’s crucial to have a well-organized Income Tax Calendar. In this blog, we’ll explore the significance of an Income Tax Calendar and how it can help you stay on top of your tax obligations.

Stay Organized:

An Income Tax Calendar provides a comprehensive overview of all tax-related deadlines, including due dates for advance tax payments, filing Income Tax Returns (ITRs), and making tax-saving investments. By having a structured timeline, you can plan your finances effectively and ensure timely compliance with tax laws.

Avoid Penalties:

Missing tax deadlines can result in hefty penalties and interest charges imposed by the tax authorities. With an Income Tax Calendar, you can avoid such penalties by staying informed about upcoming deadlines and taking necessary actions well in advance.

Plan Your Taxes:

Tax planning is an essential part of financial management. An Income Tax Calendar helps you plan your taxes efficiently by reminding you of important dates for making tax-saving investments and availing deductions under various sections of the Income Tax Act. By utilizing these opportunities, you can optimize your tax liability and maximize savings.

Reduce Stress:

Managing taxes can be overwhelming, especially if you have multiple financial activities throughout the year. An Income Tax Calendar simplifies the process by breaking down tasks into manageable chunks and providing a clear timeline for action. This helps reduce stress and ensures that you meet your tax obligations without last-minute rush.

Ensure Compliance:

Compliance with tax laws is non-negotiable. An Income Tax Calendar serves as a guide to ensure that you fulfill all your tax-related responsibilities on time. By staying compliant, you avoid legal repercussions and maintain a good standing with the tax authorities.

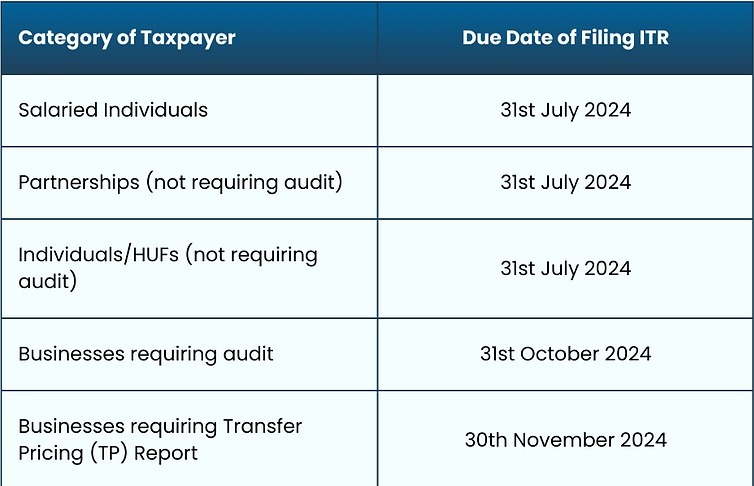

Understanding the filing due dates for Income Tax Return (ITR) is crucial to avoid penalties. Here’s a comprehensive overview of the filing due dates for different categories of taxpayers for the Financial Year 2023-2024:

Conclusion:

In conclusion, an Income Tax Calendar is a valuable tool for effective tax management. By staying organized, avoiding penalties, planning your taxes, reducing stress, and ensuring compliance with tax laws, you can navigate the tax landscape with confidence. Make it a habit to refer to your Income Tax Calendar regularly and stay ahead of your tax obligations for a financially secure future.

Head Office: Offce No.407,Lilamani corporate heights, Opposite Ramapir no Tekra BRTS stop, New Vadaj Rd, Chandramauli Society, Ahmedabad, Gujarat 380013

Pune Office: Floor No 4, Abhishek Apartment, Block sector Suvarnabaug Colony, behind Mirch Masala Hotel Kothrud Pune 411038

Hyderabad Office: Cabin No 6, NANO Coworking Space D.No:8-2-626/B, 3rd Floor, Krishna Athreya Road No: 11, Avenue 4, Banjara Hills, Hyderabad, Telangana 500034

Nashik Office: Office 1, Fourth Floor, Siddhi Pooja Business Center, Near Lions Club, New Pandit Colony, Sharanpur Road, Nashik- 422002

Mumbai Office: 6th Floor, Arihant Aura, 128, Thane – Belapur Rd, Turbhe Store, Turbhe MIDC, Turbhe, Navi Mumbai, Maharashtra 400705

Delhi Office : Space -Amigo, Co-working C25, C Block, Sector 8, Noida, Uttar Pradesh 201301

Lucknow Office : UGF Shop No 1, 1/133/358, Mahavir Ji Complex, Ganeshganj, Lucknow – 226018

Disclaimer : Vyaapar Seva Kendra is not a Government run Website and the form is not the actual registration form. At Vyaapar Seva Kendra we are collecting information from our clients so that our expert can easily understand their business needs. By proceeding forward with this website you are aware that we are a private company (SK4ALL BIZSERVE Private Limited) managing this website and we are providing assistance to our clients on the basis of the request raised.

THIS WEBSITE IS COMPLETELY FOR CONSULTANCY PURPOSE TO THE PERSON WHO DO NOT HAVE KNOWLEDGE ABOUT RULES AND REGULATIONS OF VARIOUS SERVICES, BUSINESS LICENSES AND THE OTHER COMPLIANCES.

Copyright © 2023 SK4ALL BIZSERVE Pvt. Ltd. All rights reserved. Copyrighted by SK4ALL BIZSERVE Pvt. Ltd.